How to Deposit and Trade Crypto at ApeX

How to Deposit into ApeX

How to Deposit on ApeX (Web)

1. First, go to the [ApeX] website, then log in to your [ApeX] account. Make sure that you have already connected your wallet to [ApeX].

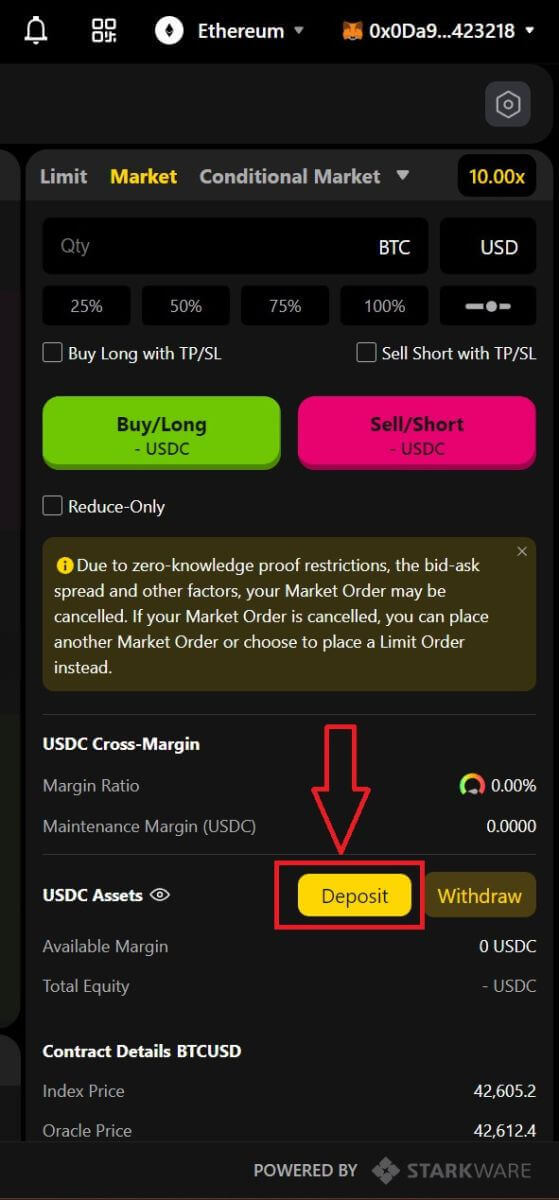

2. Click on [Deposit] on the right side of the page.

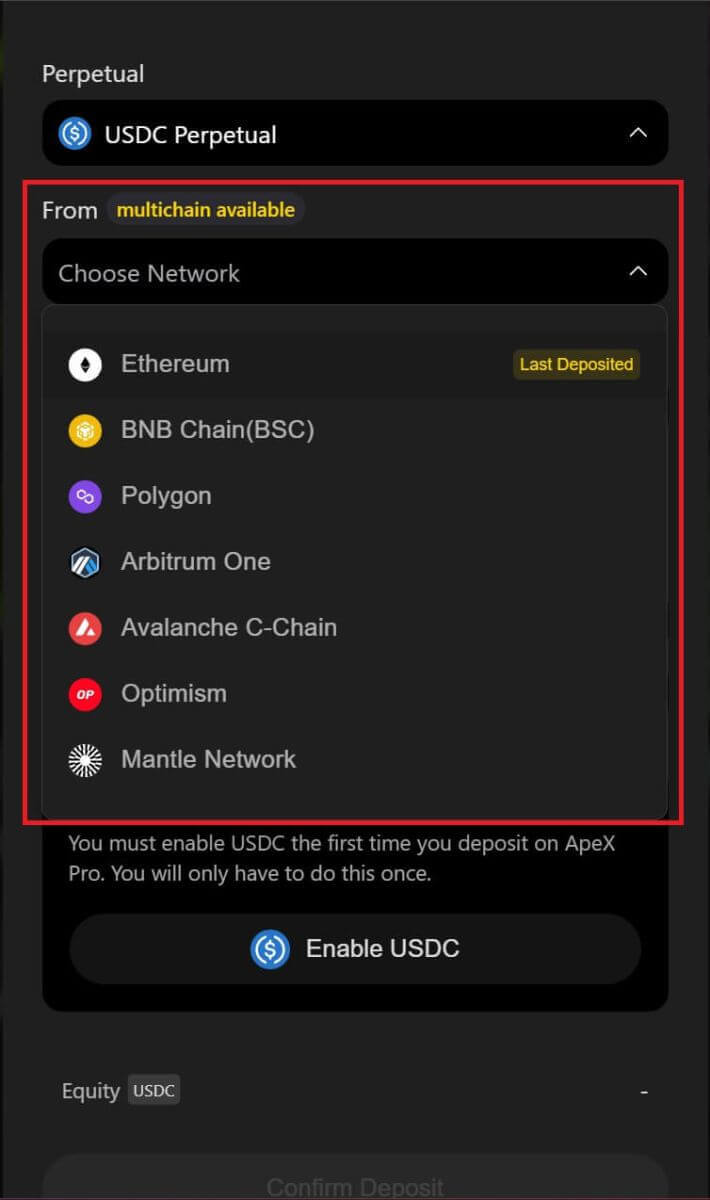

3. Select the network where you have funds available to deposit, such as Ethereum, Binance Smart Chain, Polygon, Arbitrum One, etc.

* Note: If you are not currently on the selected network, a Metamask prompt will appear asking for permission to switch to the selected network. Please approve the request to continue.

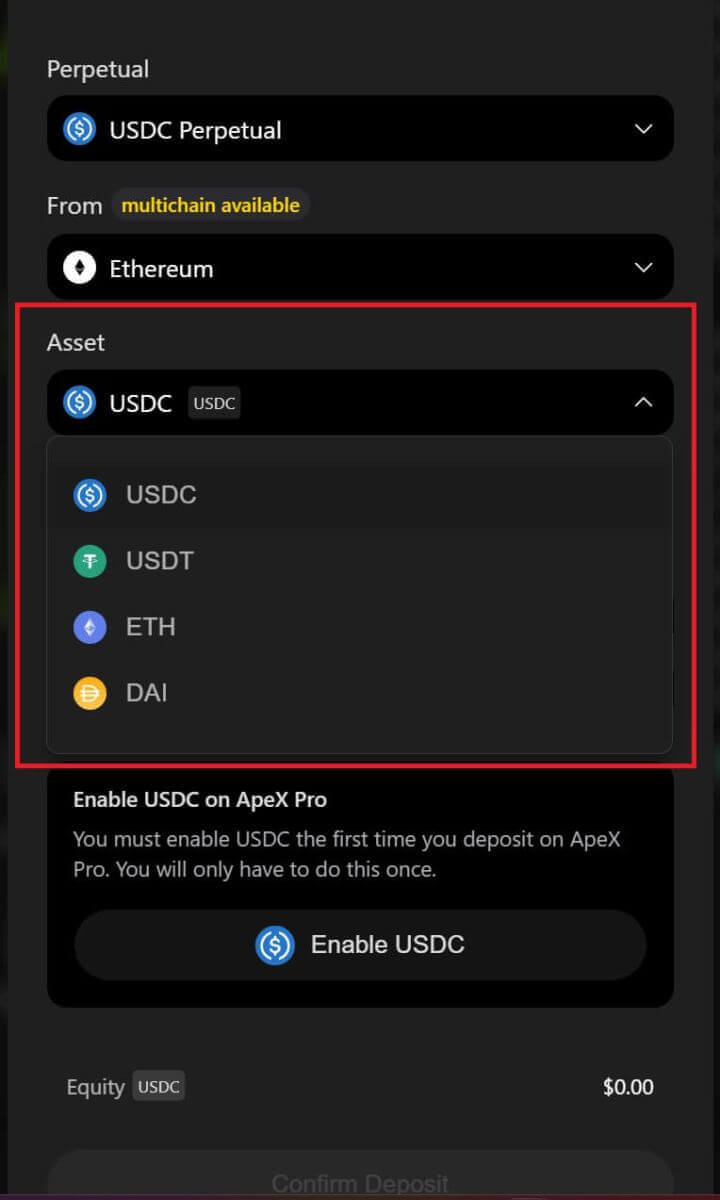

4. Select the asset you want to deposit, choose among of:

- USDC

- ETH

- USDT

- DAI

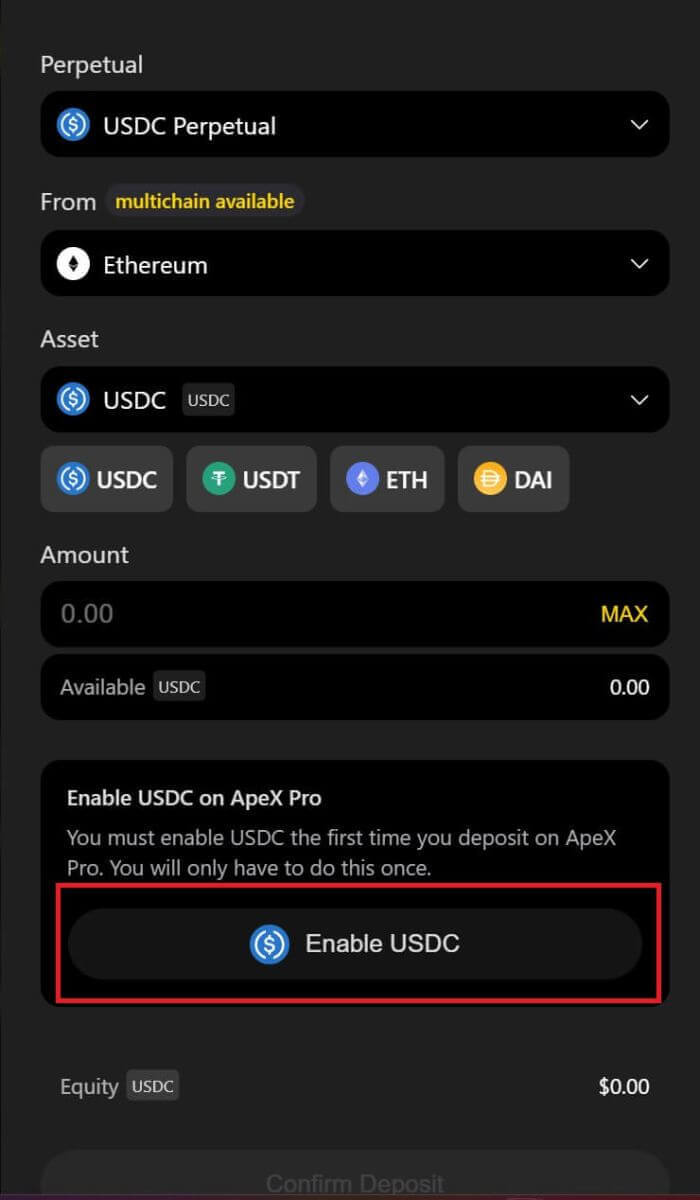

5. Please enable the selected asset to deposit. This action will cost a gas fee, so make sure you have a small amount available to sign the contract on the chosen network.

The gas fee will be paid in ETH for Ethereum and Arbitrum, Matic for Polygon, and BNB for BSC.

How to Deposit on ApeX (App)

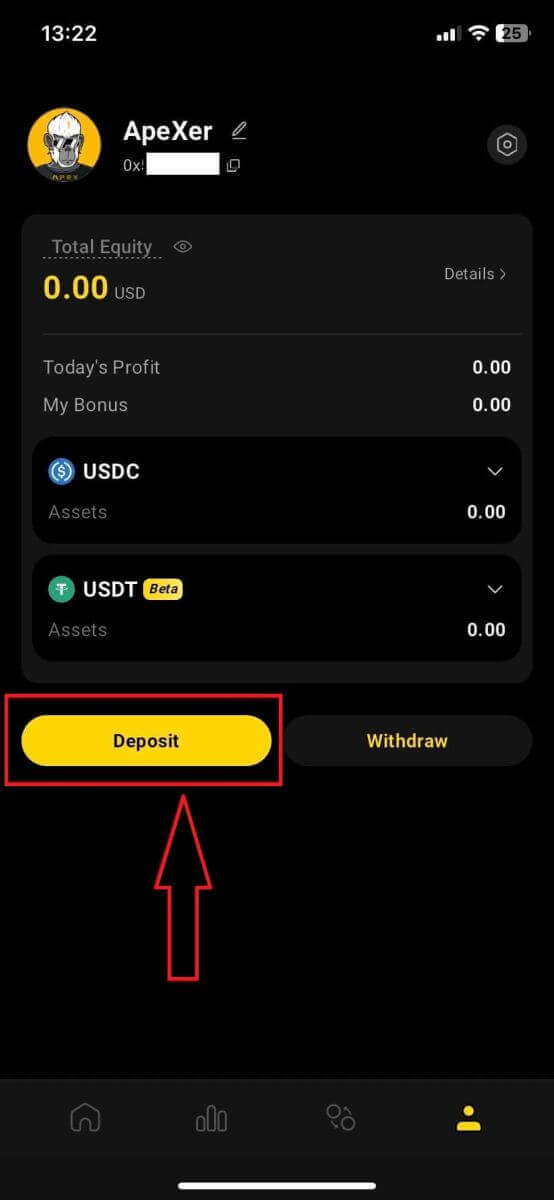

1. Click on the profile icon in the bottom right corner.

2. Choose the [Deposit] button.

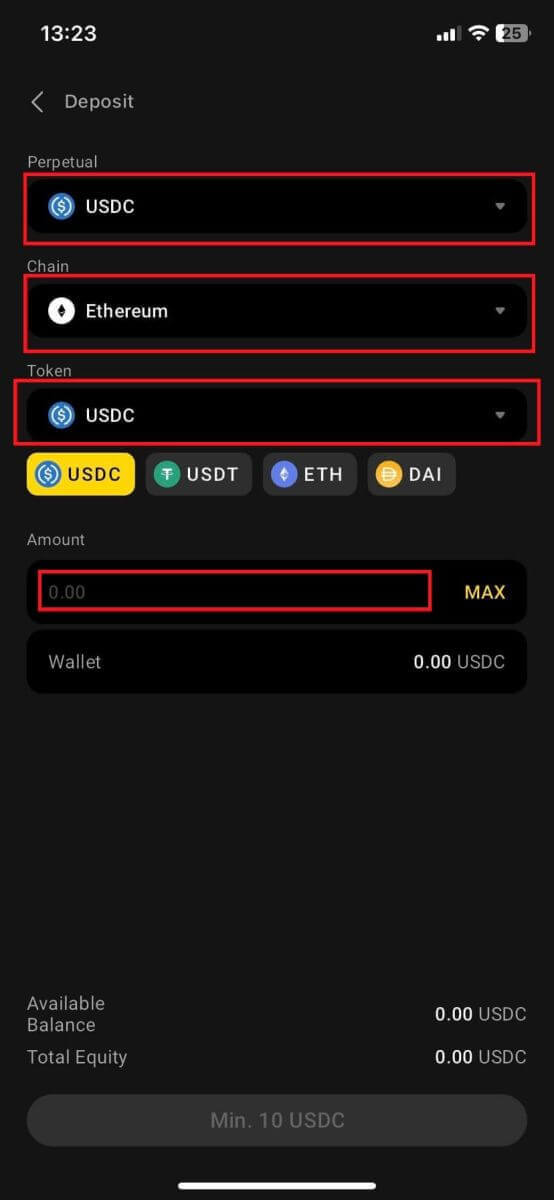

3. Here, choose the Perpetual you want to deposit, the Chain, and the Token you want to, each Token will present with the deposit ratio. Type in the amount in the box below too. After choosing all information click [Confirm] to start depositing.

How to Deposit on ApeX with MPC Wallet

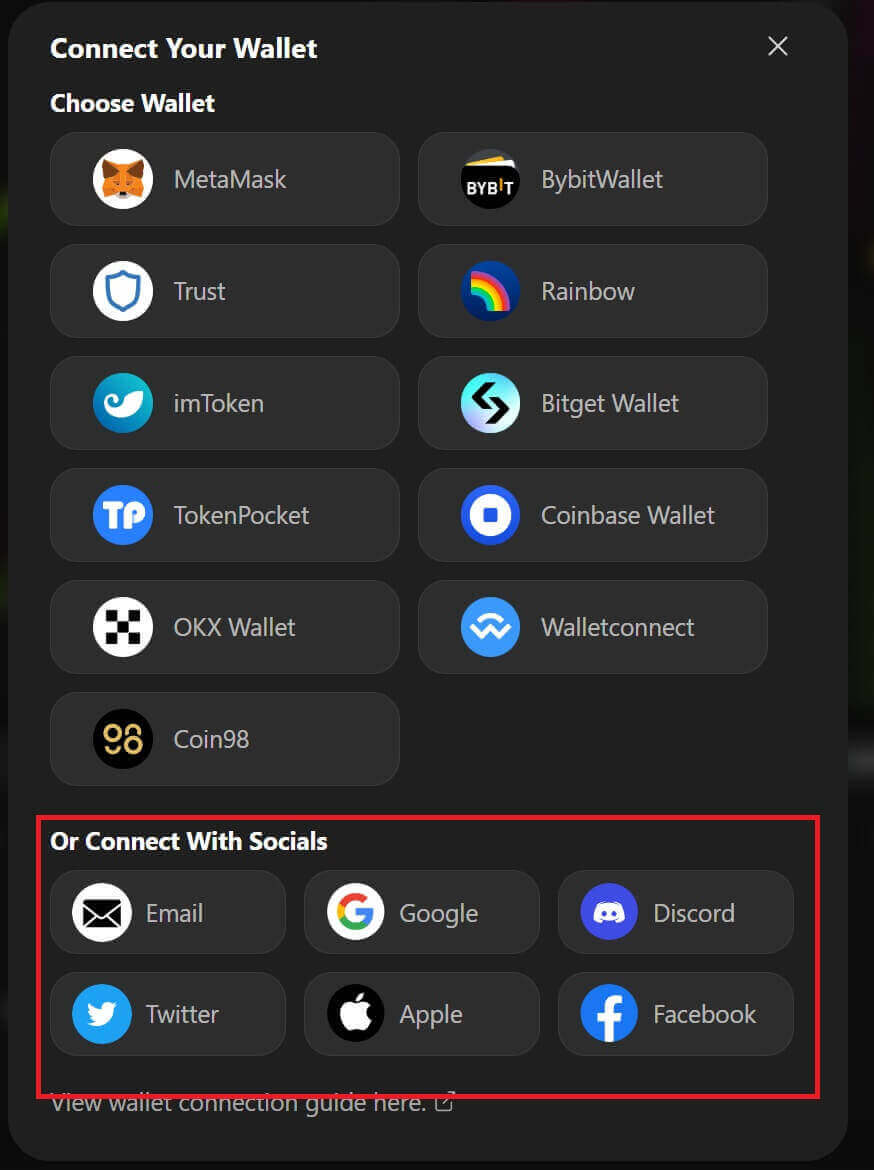

1. Select your preferred social login methods under the new [Connect With Social] feature.

2. Receive deposited funds or make a transfer from your account.

- Desktop: Click on your wallet address in the upper-right corner of the page.

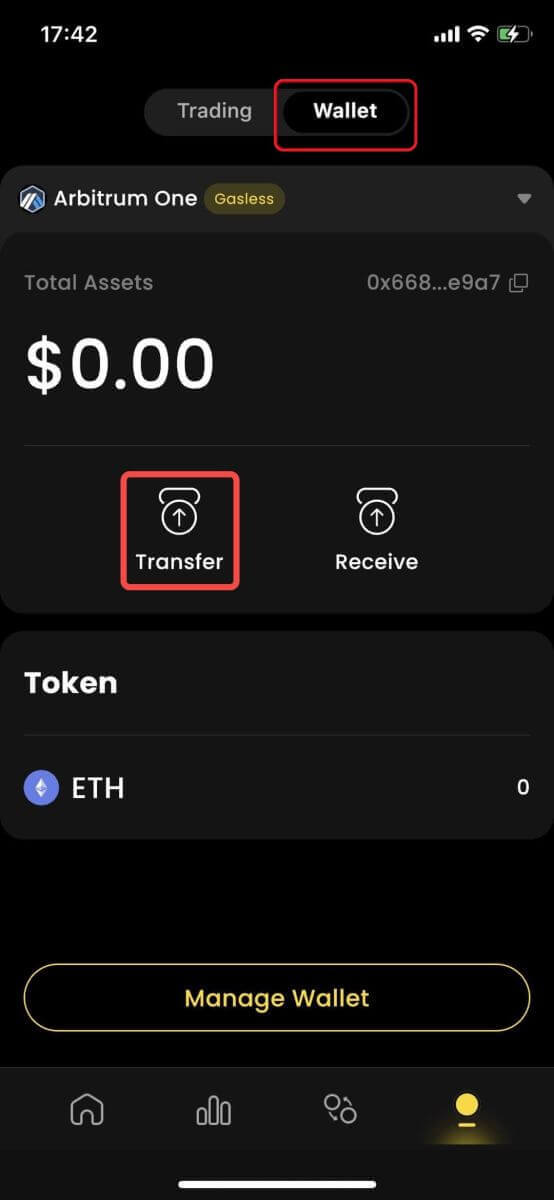

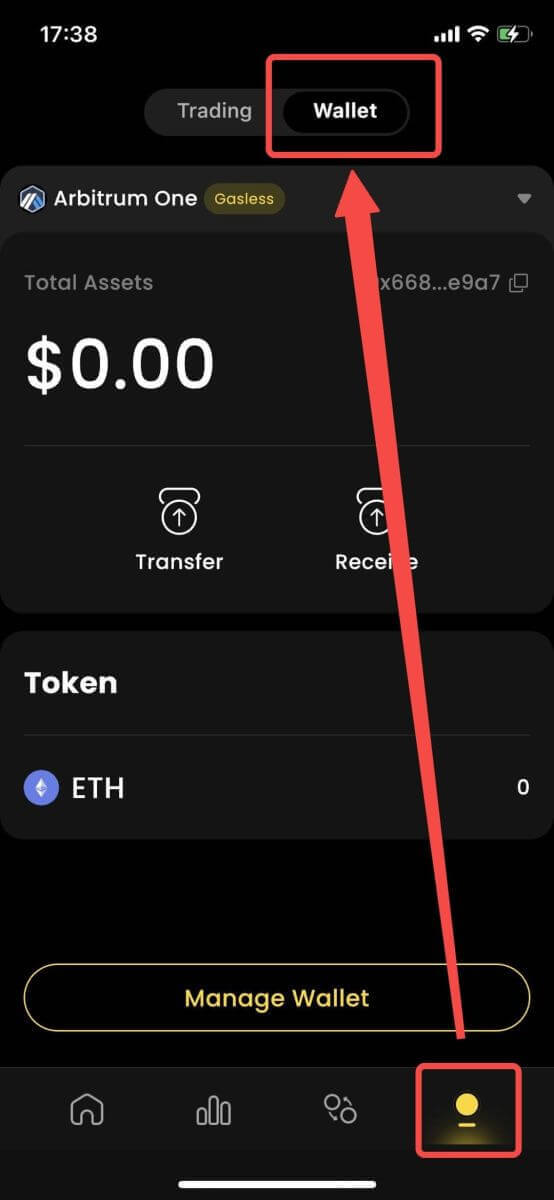

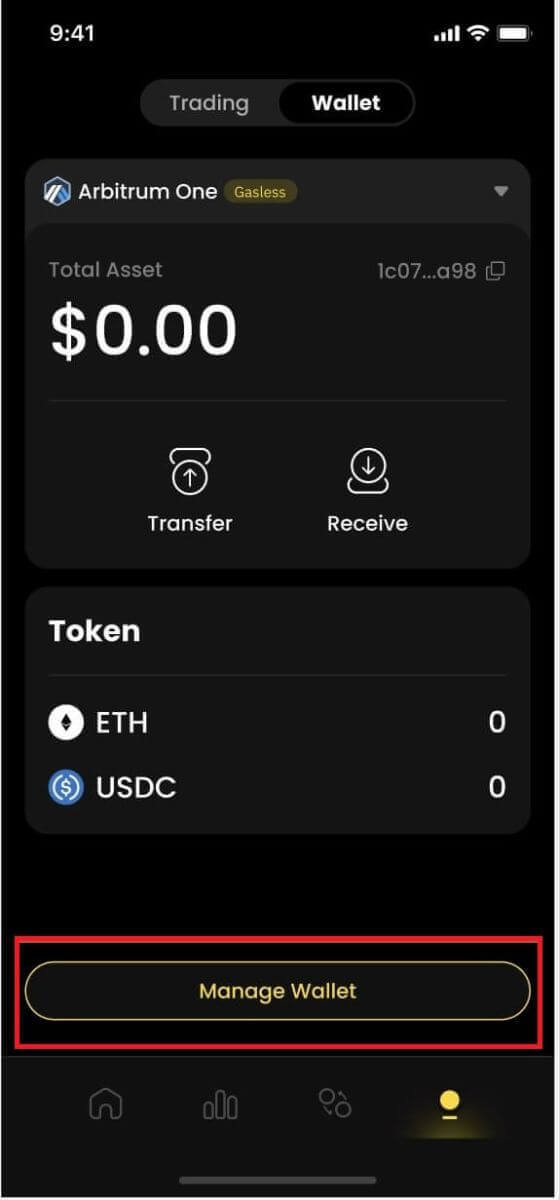

- App: Tap on the right-most icon to access your profile, and then click on the [Wallet] tab.

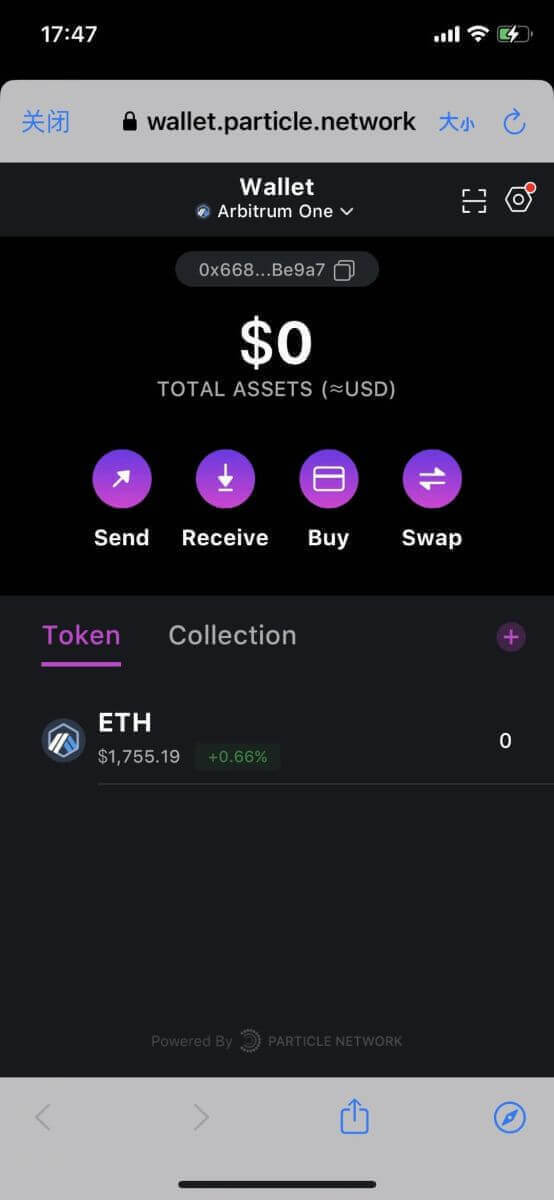

3. Next is what deposits look like on the Desktop and App

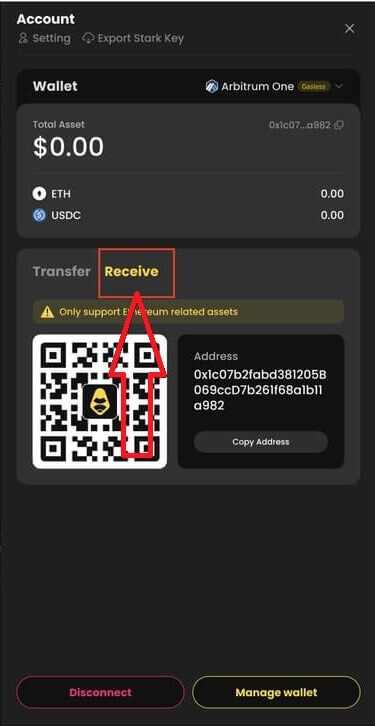

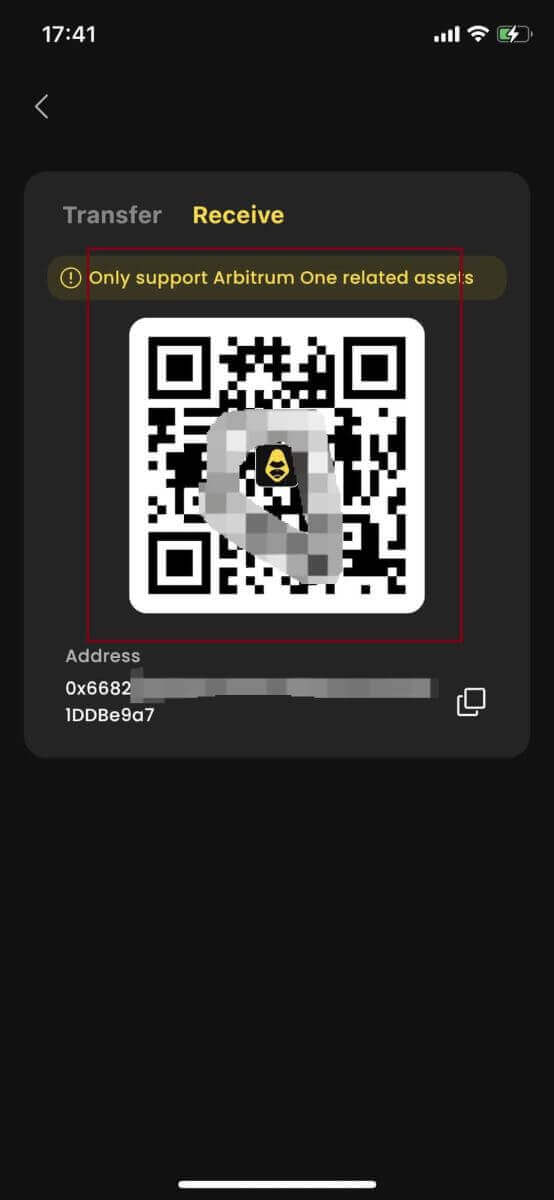

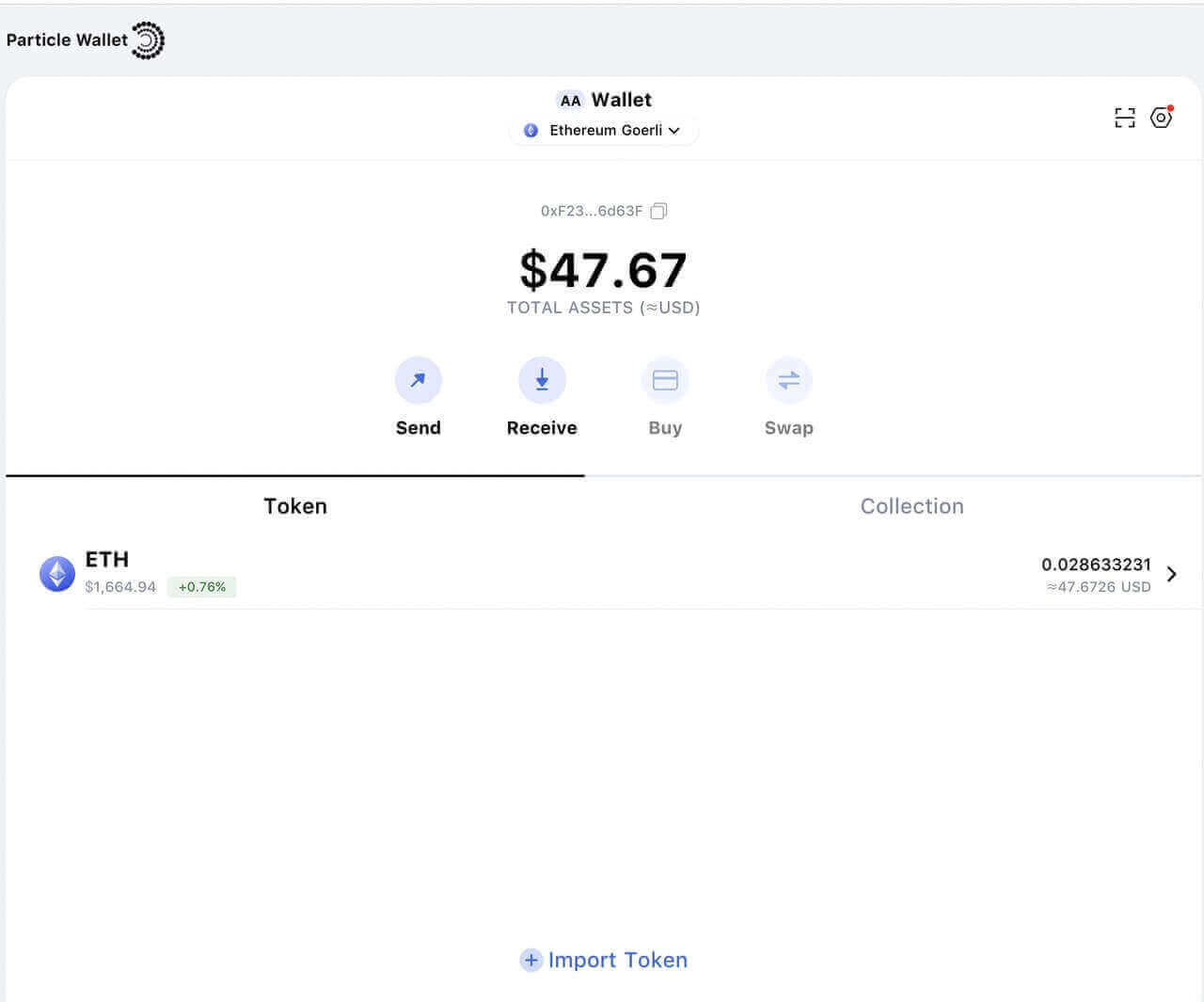

- Desktop: Click on [Receive] and copy the provided wallet address, or scan the QR code from another wallet application (you can choose to scan with your in-centralized exchange wallet or other similar wallet applications) to make a deposit into Particle Wallet. Please take note of the selected chain for this action.

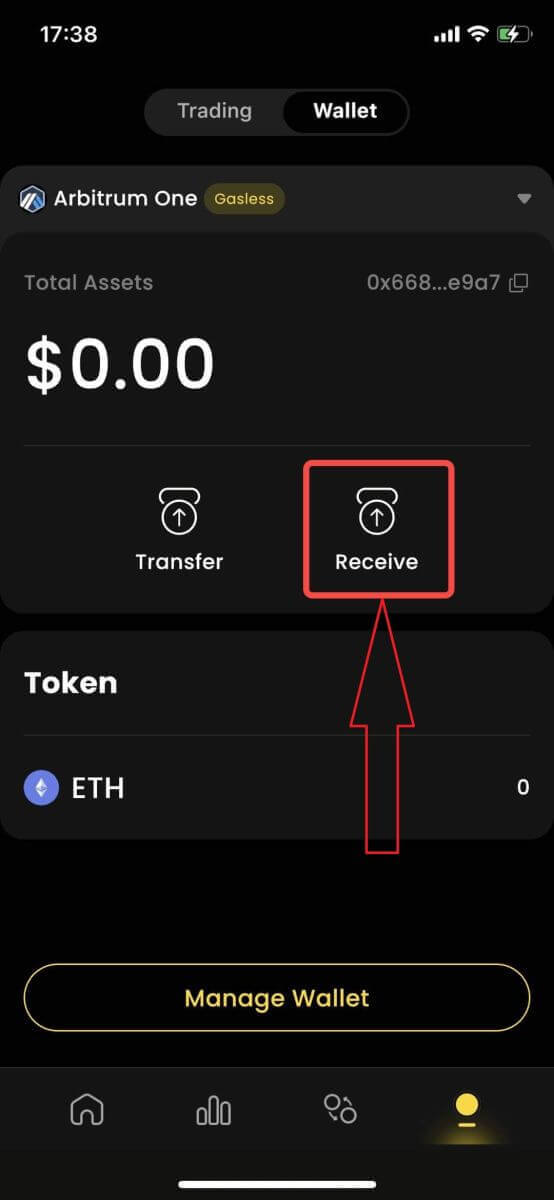

- App: This is what the same process looks like on the app.

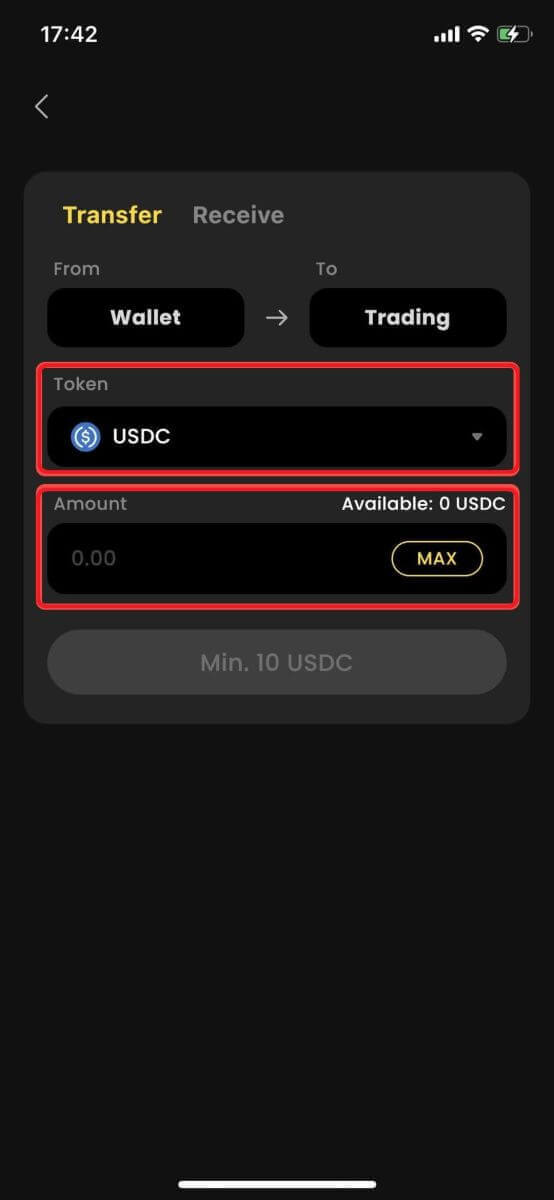

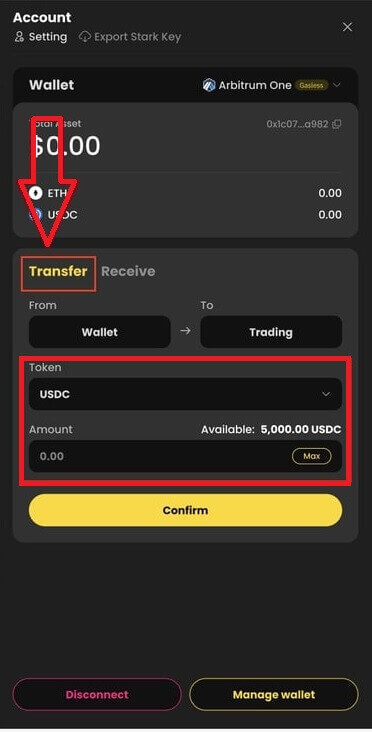

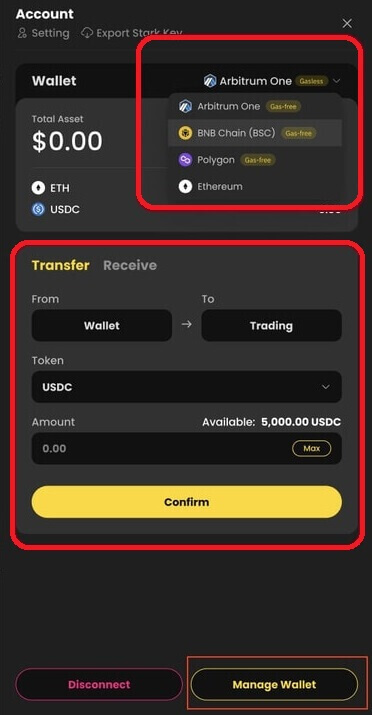

4. If you want to transfer to your trading account in [ApeX], here is what it looks like:

- Desktop: Click on the [Transfer] tab and enter your desired amount of funds for transfer. Please ensure that the amount entered is greater than 10 USDC. Click on [Confirm].

- App: This is what the same process looks like on the app.

How to Manage MPC Wallet on ApeX

1. Manage wallet on Desktop:- Desktop: Click on Manage Wallet to access your Particle Wallet. You will be able to access the full functionality of the Particle Wallet, including send, receive, swap, purchase tokens with fiat, or view more wallet settings.

2. Manage wallet on App:

- App: This is what the same process looks like on the App.

How to Trade Crypto on ApeX

Trade Crypto on ApeX

Here’s how to easily execute trades with ApeX Pro in three easy steps. See the glossary if unfamiliar with any of the terms used.

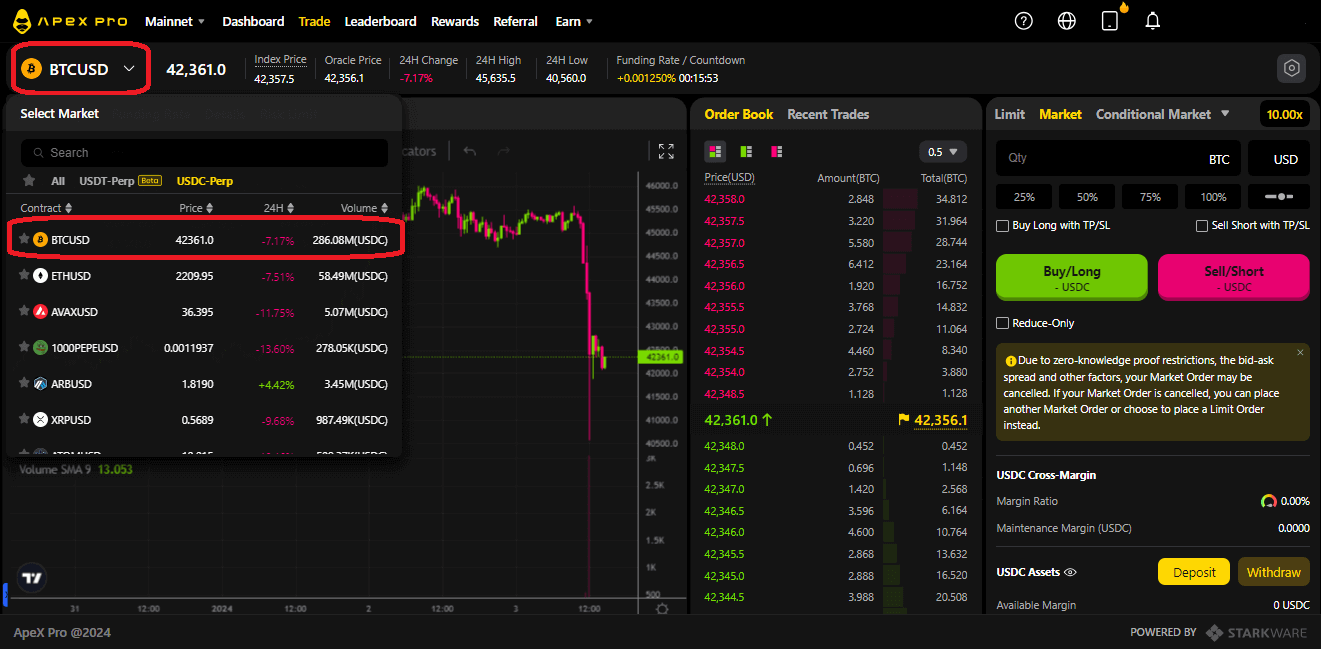

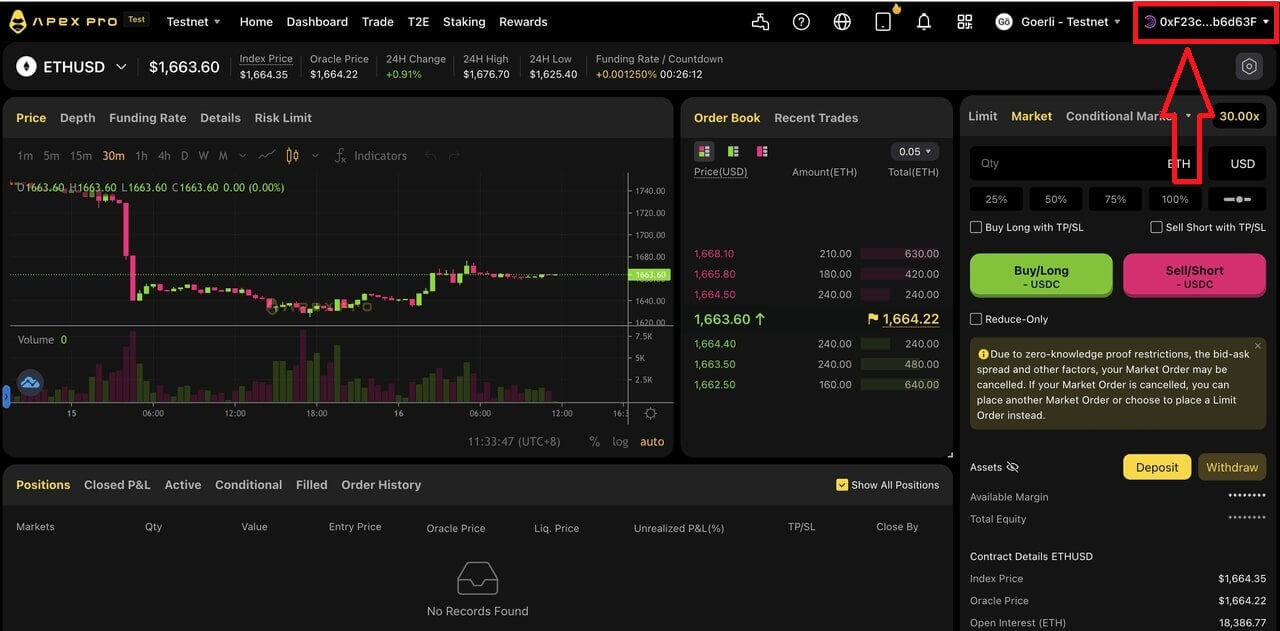

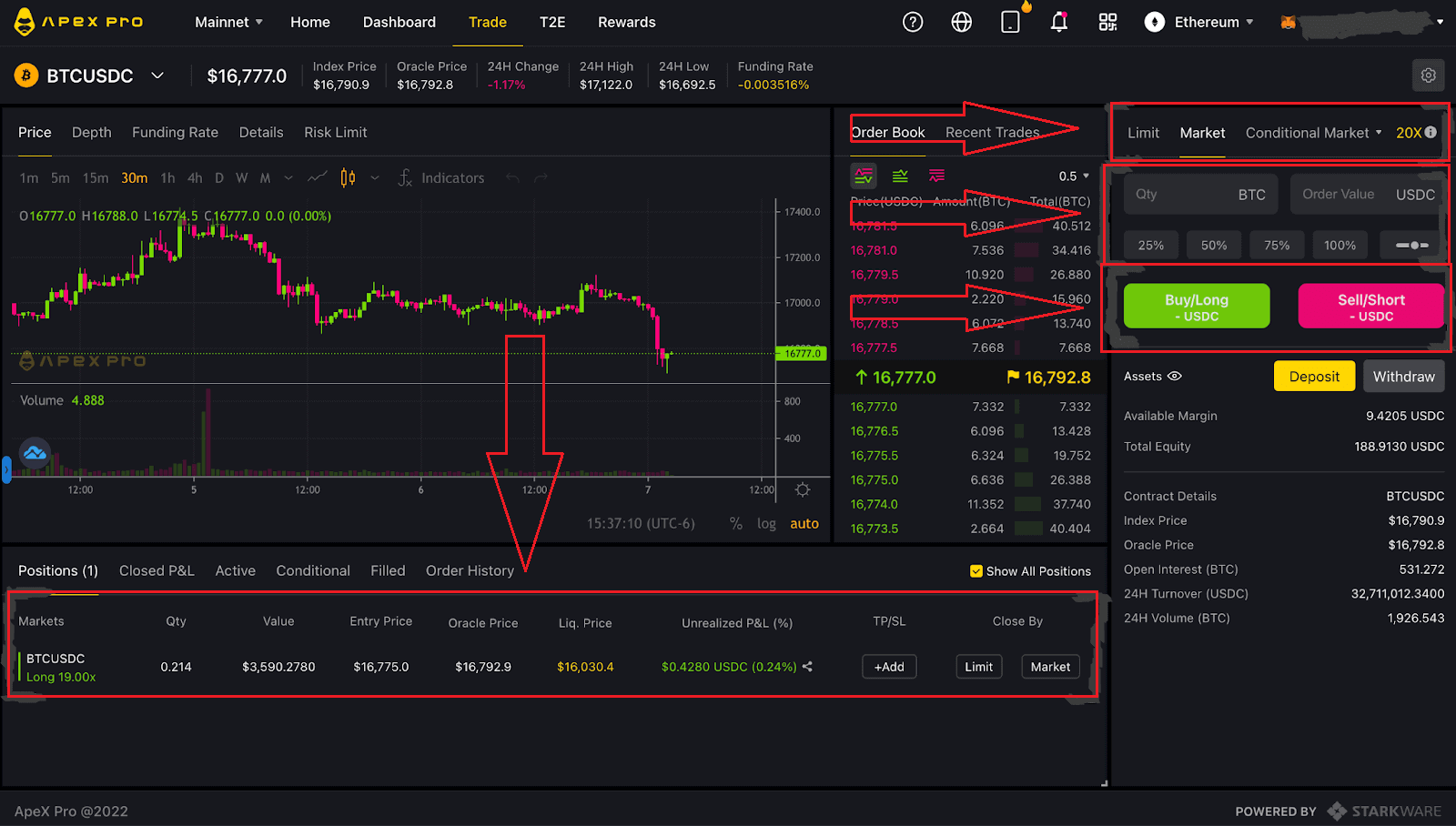

- Select your desired trading contract. That’s found in the drop-down menu at the upper left of your screen. For this example, we will use BTC-USDC.

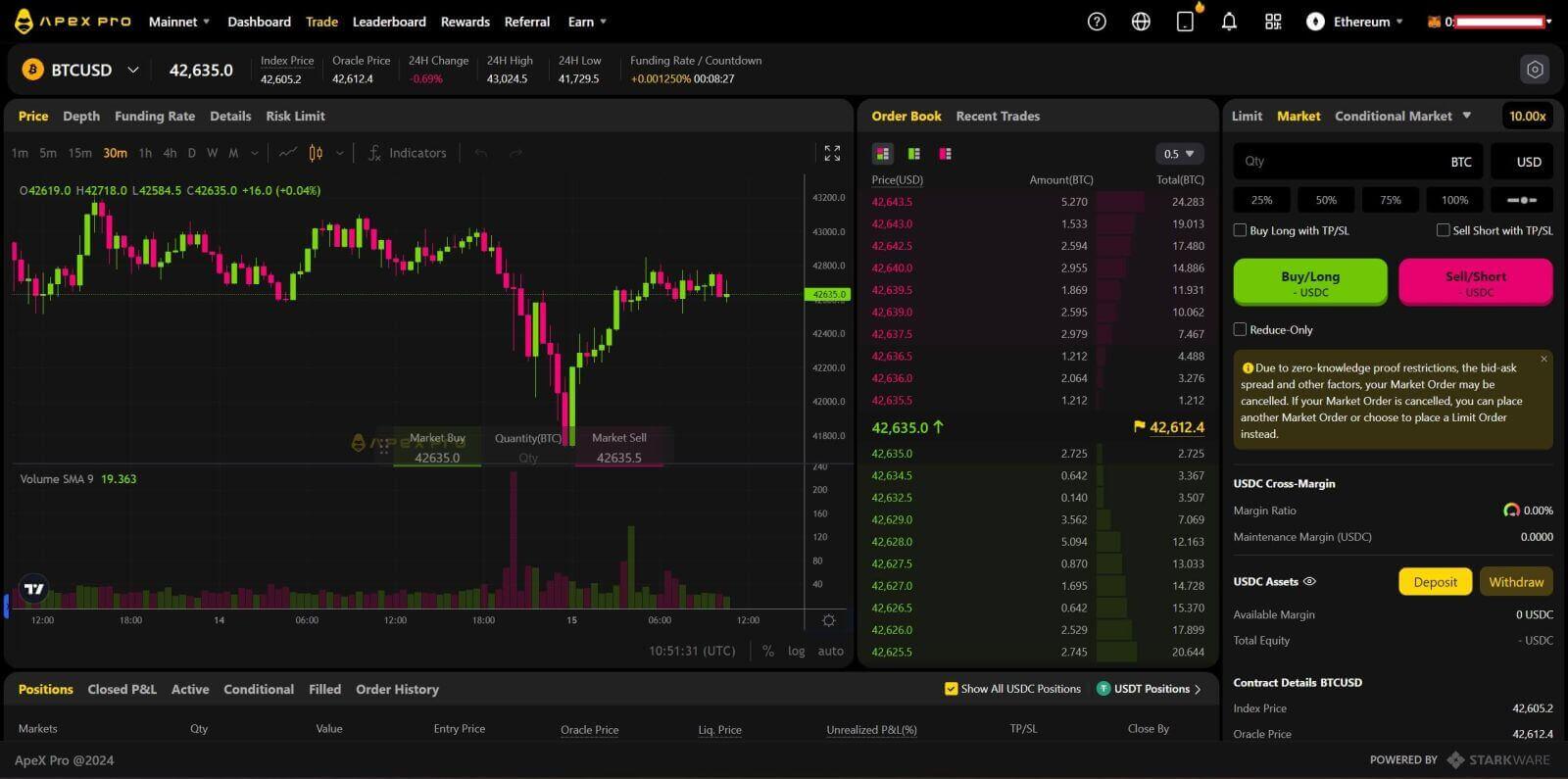

- Next, decide on a long or short trade and choose between a Limit, Market, or Conditional Market order. Specify the amount of USDC for the trade, and simply click submit to execute the order. Double-check your details before submitting to ensure they match your trading strategy.

Your trade is now open!

For this trade, I longed BTC with approximately 180 USDC at 20x leverage. Notice the position status window at the bottom of the screen shot. ApeX Pro shows your leverage order details, liquidation price, and updated unrealized PL. The position status window is also how you close out your trade.

- To finalize your trade, establish your take profit and stop loss limits, or set a sell limit. If an immediate closure is necessary, click on "Market" and execute the closeout. This ensures a swift and efficient process for closing your position on ApeX Pro.

Glossary of Terms

- Cross Margin: Margin is your collateral. Cross-margin means the entire available balance under your account will be used to meet margin requirements. Thus, your entire account is at risk for liquidation if your trade goes the wrong way. Stop Loss Army Unite!!!

- Leverage: Financial tool allowing traders to increase their market exposure beyond their initial investment. For example, 20X leverage means a trader can enter a position for $20,000 worth of BTC with only $1,000 of collateral. Remember, the odds of gains, losses, and liquidation exponentially increase as leverage increases.

- Market Order: An order to buy or sell an asset at the current market price.

- Limit Order: This is an order to buy or sell at a specific price. The asset will not be bought or sold until it is triggered by that price.

- Conditional Order: Either a conditional limit or conditional market order to buy or sell an asset that only takes effect only once a certain trigger price condition has been met.

- Perpetual Contracts: A perpetual contract is an agreement with another party to buy or sell an underlying asset at a predetermined price. The contract follows the price action of the asset, but the actual asset is never owned or traded. Perpetual contracts have no expiry date.

- Take Profit: A profit exit strategy which ensures that the trade is automatically closed once the asset hits a certain profitable price.

- Stop Loss: A risk management tool that automatically closes the trader’s position at a loss in case the trade goes the wrong way. Stop losses are used to avoid substantial losses or liquidation. It’s better to trim a bit off the top than be scalped. Use them.

Order Types on ApeX

There are three order types that are available on perpetual contract trades at ApeX Pro including: Limit Order, Market Order and Conditional Orders.

Limit Order

A limit order allows you to place an order at a specific or better price. However, there’s no guarantee of immediate execution, as it is fulfilled only when the market reaches your chosen price. For a buy limit order, execution happens at the limit price or lower, and for a sell limit order, it occurs at the limit price or higher.

- Fill-or-Kill is an order that must be filled immediately or will be canceled

- Good-Till-Time will ensure that your order is effective until it is fulfilled or the maximum default period of 4 weeks is reached

- Immediate-or-Cancel specifies that the order must be executed at the limit price or better immediately, or will be canceled

Additionally, further customize your order by adding execution conditions with Post-Only or Reduce-Only.

- Post-Only: Enabling this option ensures that your order is posted on the order book without being matched immediately. It also guarantees that the order is only executed as a maker order.

- Reduce-Only: This option ensures helps to dynamically reduce or adjust your limit order’s contract quantity and ensuring that your position will not be unintentionally increased.

For example, Alice would like to buy an order quantity of 5 ETH worth in ETH-USDC contracts.

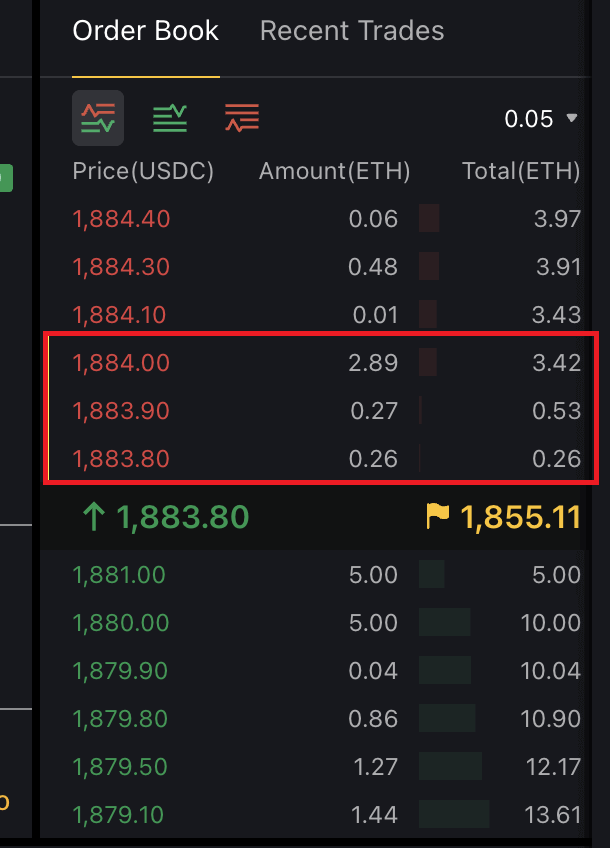

Looking at the order book, if the best sell price is at $1,890, she’d like to fill her order at a limit price of no more than $1,884. She also selects the "Good-Till-Time" and Post-Only execution options on her order.

Once her limit price is reached, she checks the available quantity at her limit price and below. For instance, at $1,884, there is 2.89 ETH worth in ETH-USDC contracts available. Her order will be partially filled initially. Using the Good-Till-Time feature, the unfilled quantity is added to the order book for another attempt at execution. If the remaining order isn’t completed within a default 4-week period, it will be automatically canceled.

Once her limit price is reached, she checks the available quantity at her limit price and below. For instance, at $1,884, there is 2.89 ETH worth in ETH-USDC contracts available. Her order will be partially filled initially. Using the Good-Till-Time feature, the unfilled quantity is added to the order book for another attempt at execution. If the remaining order isn’t completed within a default 4-week period, it will be automatically canceled.Market Order

A market order is a buy or sell order that is instantly filled at the best available market price upon submission. It relies on the existing limit orders on the order book for execution.While the execution of a Market Order is guaranteed, the trader cannot specify prices; only the contract type and order amount can be specified. All time-in-force and execution conditions are pre-set as part of the nature of a Market Order.

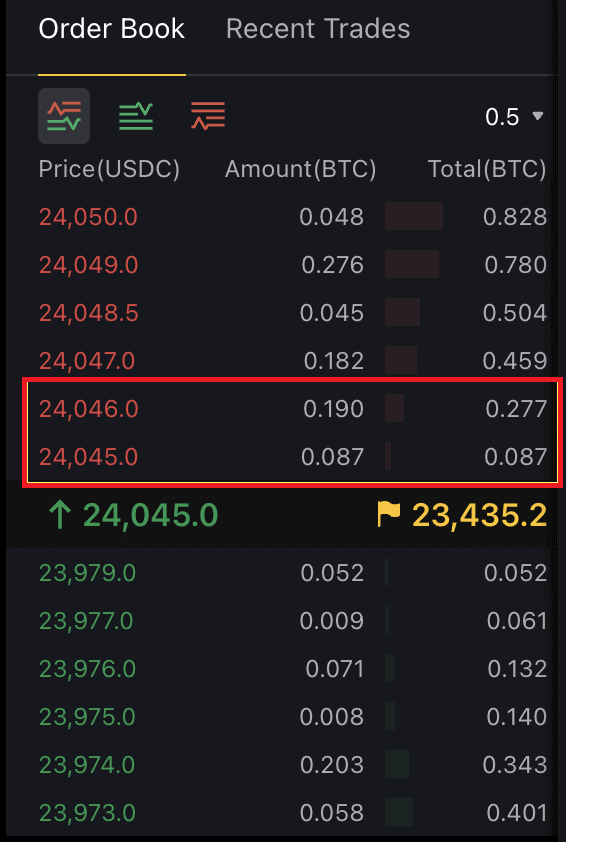

For example, if you’d like to purchase 0.25 BTC worth in BTC-USDC contracts, ApeX Pro will instantly fill the first portion of your contract with the best price available, and the remainder with the second best price thereafter as seen in the image above.

For example, if you’d like to purchase 0.25 BTC worth in BTC-USDC contracts, ApeX Pro will instantly fill the first portion of your contract with the best price available, and the remainder with the second best price thereafter as seen in the image above.Conditional Orders

Conditional Orders are Market or Limit Orders that have specific conditions tagged to them — Conditional Market and Conditional Limit orders. This allows traders to set an added trigger price condition on either your Market or Limit Orders.- Conditional Market

For instance, if you aim to buy $40,000 in BTC-USDC contracts with a trigger price set at $23,000, ApeX Pro will execute your order at the best available prices as soon as the trigger price is achieved.

- Conditional Limit

For instance, if you set a limit order at $22,000 for 5 BTC without a trigger price, it’s immediately queued for execution.

Introducing a trigger price, such as $22,100, means the order becomes active and queued in the order book only when the trigger price is met. Additional options like time-in-force, post-only, and reduce-only can be incorporated for enhanced trade customization with Conditional Limit Orders.

How to use Stop-Loss and Take-Profit on ApeX

- Take-Profit (TP): Close your position once you’ve reached a specified level of profit.

- Stop-Loss (SL): Exit your position once the asset reaches a specified price to mitigate capital losses on your order when the market moves against you.

Here’s how you can set up Take-Profit and Stop-Loss on your Limit, Market and Conditional (Market or Limit) orders. Before you begin, please ensure that you are logged into your ApeX Pro account and that your wallet is successfully connected to the platform.

(1) On the trading page, choose the contract you want to trade. Create your order – be it Limit, Market, or Conditional (Limit or Market) – by selecting the appropriate option from the panel on the right side.

(2) Fill in your order accordingly. For a recap on ApeX Pro’s order types and how to create each order, please refer to Order Types.

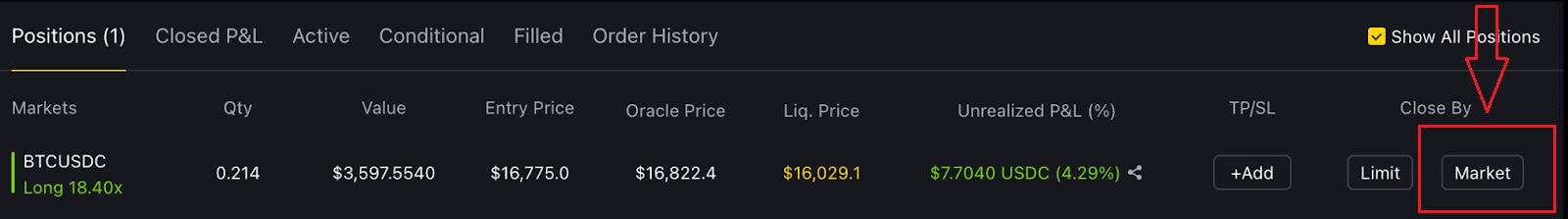

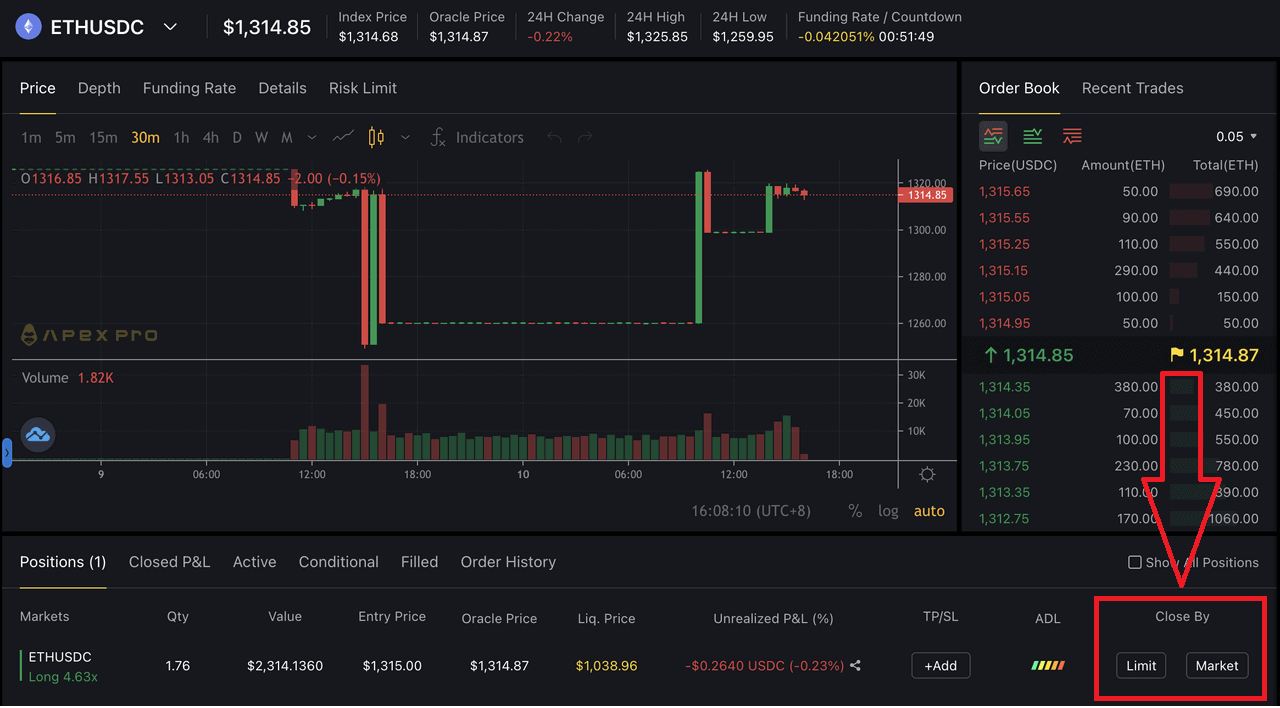

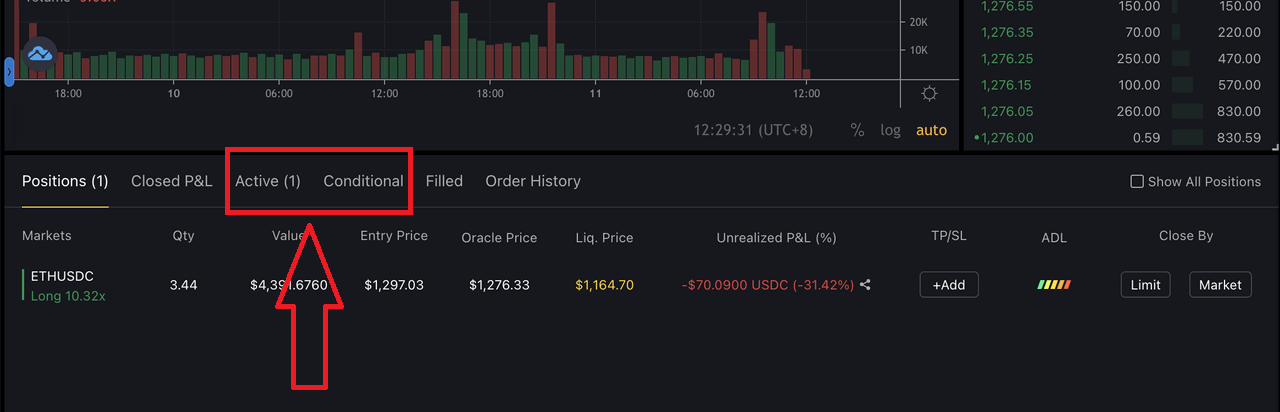

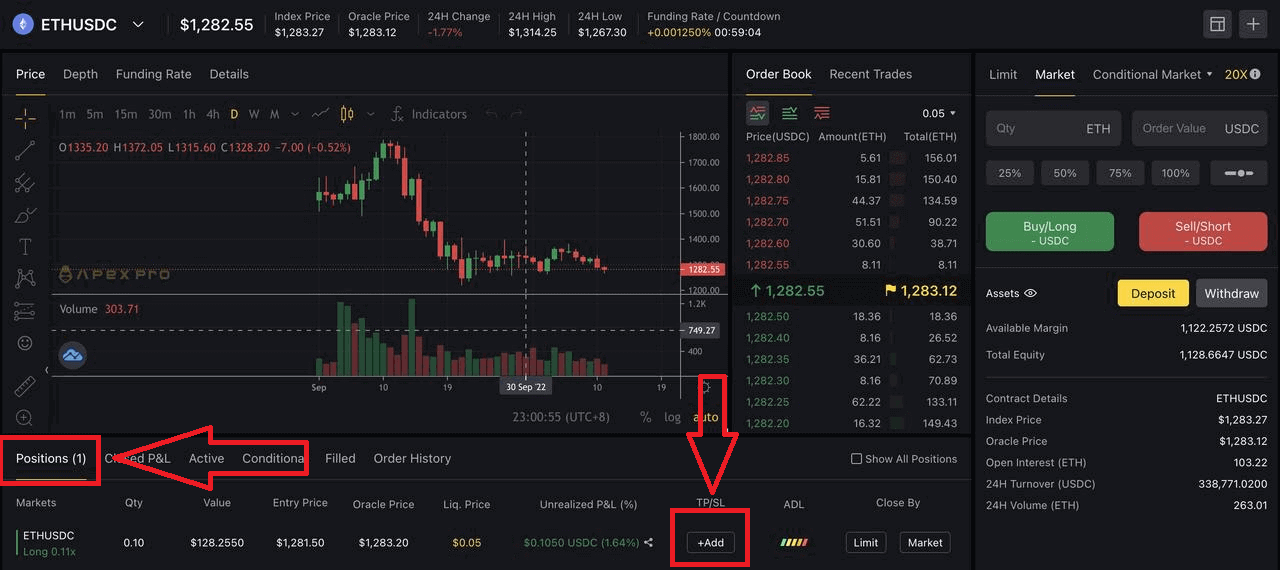

(2) Fill in your order accordingly. For a recap on ApeX Pro’s order types and how to create each order, please refer to Order Types.(3) Please note that you can only select and configure TP/SL options after your order is executed. This means that for Limit and Conditional (Market or Limit) orders, you will need to wait for the orders to move from a pending status (under Active or Conditional) into the "Positions" tab at the bottom of the trading page here. As Market orders are immediately executed at the best available price, you will not need to wait for the order to be triggered by a set price before setting TP/SL in the same way.

(4) By default, all TP/SL orders are Reduce-Only orders on ApeX Pro.

(4) By default, all TP/SL orders are Reduce-Only orders on ApeX Pro.(5) Check out your open positions under the "Postions" tab and click on the [+Add] button to s

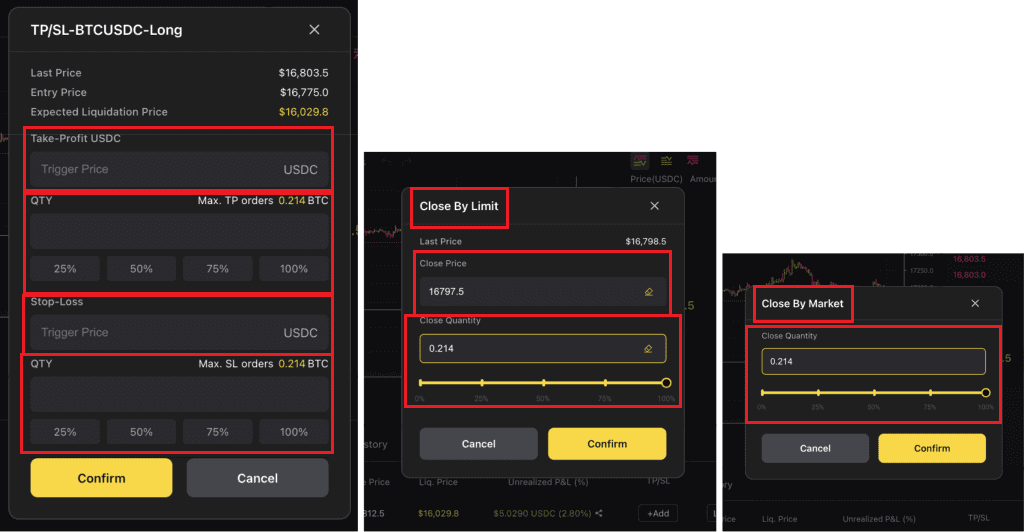

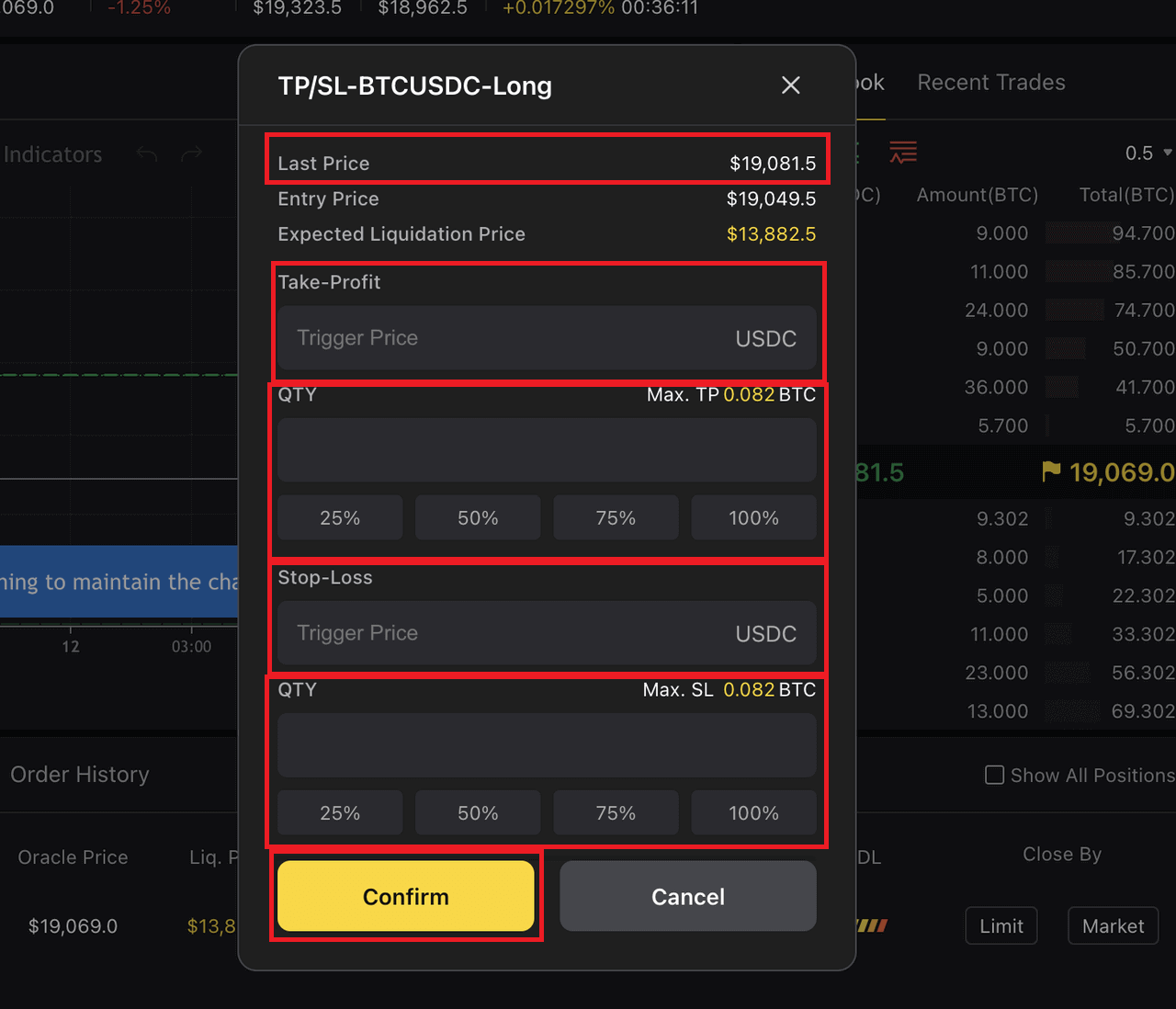

(6) A new window will pop up and you’ll see the following fields:

- All TP/SL orders can only be triggered by Last Traded Price.

- You can fill up either the Take-Profit or Stop-Loss sections, or both if you would like to set both conditions on your order(s).

- Enter the Take-Profit trigger price and the quantity — you can choose to have the set TP condition apply only to a partial or the entirety of your order.

- The same applies for Stop-Loss — choose to have the set SL condition apply only to a partial or the entirety of your order.

- Click on "Confirm" once you’ve verified the details of your order.

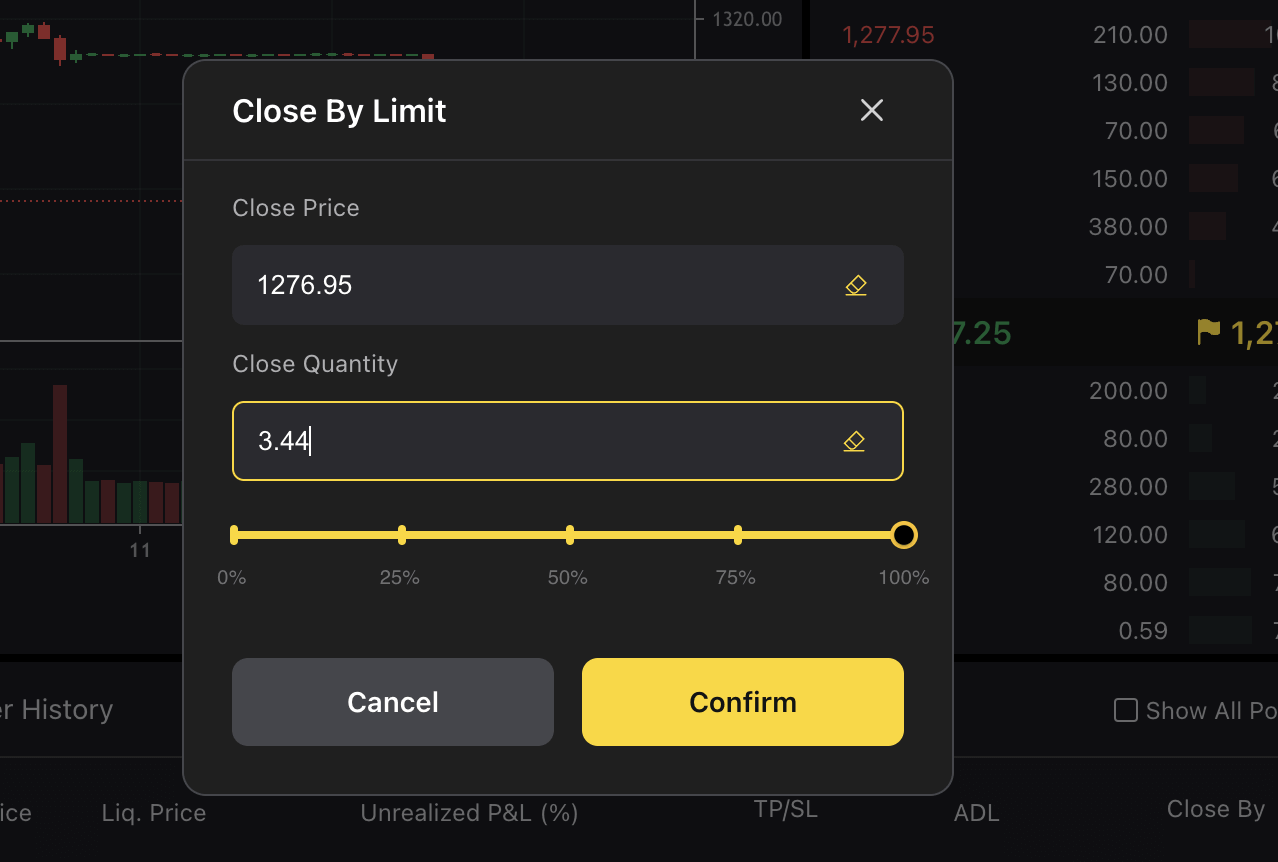

(7) Alternatively, you can employ the Close By Limit function to establish Take-Profit orders, providing a similar function as described in Step 6 above. It’s important to note that this method is not applicable for setting up Stop-Loss orders.

Frequently Asked Questions (FAQ)

Trading Fees

Fee Structure

ApeX Pro uses a maker-taker fee model for determining its trade fees. There are two types of orders on ApeX Pro — Maker and Taker orders.- Maker orders add depth and liquidity to the order book as they are orders that are not executed and filled immediately

- Taker orders, on the other hand, are executed and filled immediately, removing liquidity from the order book

ApeX Pro will introduce a tiered trading fee structure soon so traders can enjoy even greater cost reductions on fees, the more they trade.

Will I be charged if I cancel my order?

No, if your order is open and you cancel it, you will not be charged a fee. Fees are only charged on filled orders.

Do I have to pay gas fees to trade?

No. Since trades are executed on Layer 2, no gas fees will be charged.

Funding Fees

Funding is the fee paid to either long or short traders to ensure that trading price closely follows the price of the underlying asset on the spot market.Funding Fees

Funding fees will be exchanged between long and short position holders every 1 hour.

Please note that the funding rate will fluctuate in real time every 1 hour. If the funding rate is positive upon settlement, long positions holders will pay the funding fees to short position holders. Similarly, when the funding rate is negative, short positive holders will pay long position holders.

Only traders who hold positions at the time of settlement will pay or receive funding fees. Likewise, traders who do not hold any positions when at the time of funding payment settlement will neither pay nor receive any funding fees.

Your position value at the timestamp when funding is settled will be used to derive your funding fees.

Funding Fees = Position Value * Index Price * Funding Rate

The funding rate is calculated every hour. For example:

- The funding rate between 10AM UTC and 11AM UTC, and will be exchanged at 11AM UTC;

- The funding rate between 2PM UTC and 3PM UTC, and will be exchanged at 3PM UTC

Funding Rate Calculations

The funding rate is calculated based on Interest Rate (I) and Premium Index (P). Both factors are updated every minute, and an N*-Hour Time-Weighted-Average-Price (TWAP) over the series of minute rates is performed. The Funding Rate is next calculated with the N*-Hour Interest Rate component and the N*-Hour premium / discount component. A +/−0.05% dampener is added.

- N = Funding Time interval. Since funding occurs once per hour, N = 1.

- Funding Rate (F) = P + clamp * (I - P, 0.05%, -0.05%)

This means that if (I - P) is within +/-0.05%, the funding rate is equivalent to the interest rate. The resulting funding rate is used to determine the position value, and correspondingly, the funding fees to be paid by long and short position holders.

Taking BTC-USDC contract as an example, where BTC is the underlying asset and USDC as the settlement asset. According to the formula above, the interest rate would be equivalent to the difference in interest between both assets.

Interest Rate

-

Interest Rate (I) = (USDC Interest - Underlying Asset Interest) / Funding Rate Interval

- USDC Interest = The interest rate for borrowing the settlement currency, in this case USDC

- Underlying Asset Interest = The interest rate for borrowing the base currency

- Funding Rate Interval = 24/Funding Time Interval

Using BTC-USDC as an example, if USDC interest rate is 0.06%, BTC interest rate is 0.03%, and the funding rate interval is 24:

- Interest Rate = (0.06-0.03) / 24 = 0.00125%.

Premium Index

Traders can enjoy discounts from the oracle price with the utilization of a Premium Index — this is used to raise or lower the next funding rate so that it aligns with the level of the contract trade.

-

Premium Index (P) = ( Max ( 0 , Impact Bid Price - Oracle Price) - Max ( 0 , Oracle Price - Impact Ask Price)) / Index Price + Funding Rate of Current Interval

- Impact Ask Price = The average fill price to execute the Impact Margin Notional on the Ask side

- Impact Bid Price = The average fill price to execute the Impact Margin Notional on the Bid side

Impact Margin Notional is the notion available to trade based on a certain amount of margin and indicates how deep in the order book to measure either the Impact Bid or Ask Price.

Funding Fee Cap

| Contract | Maximum | Minimum |

| BTCUSDC | 0.046875% | -0.046875% |

| ETHUSDC、BCHUSDC、LTCUSDC、XRPUSDC、EOSUSDC、BNBUSDC | 0.09375% | -0.09375% |

| Others | 0.1875% | -0.1875% |

*Only BTC and ETH perpetual contracts are available now. Other contracts will be added to ApeX Pro soon.