Frequently Asked Questions (FAQ) on ApeX

Wallet

Is your platform safe? Are your smart contracts audited?

Yes, smart contracts on ApeX Protocol (and ApeX Pro) are fully audited by BlockSec. We are also planning to support a bug bounty campaign with secure3 to help mitigate the risk of exploits on the platform.What wallets does Apex Pro support?

Apex Pro currently supports:- MetaMask

- Trust

- Rainbow

- BybitWallet

- Bitget Wallet

- OKX Wallet

- Walletconnect

- imToken

- BitKeep

- TokenPocket

- Coinbase Wallet

Can Bybit users connect their wallets to ApeX Pro?

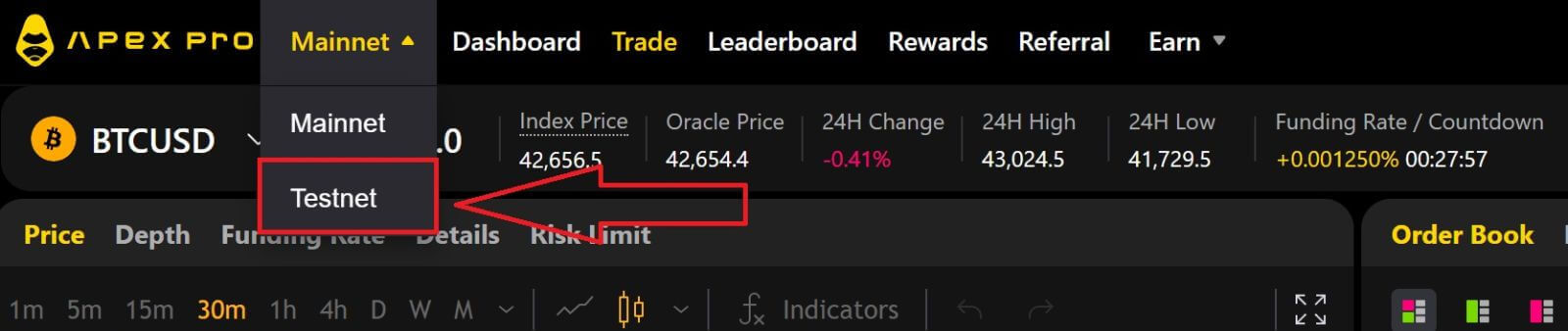

Bybit users can now connect their Web3 and Spot wallets to Apex Pro.How do I switch to testnet?

To view the Testnet options, connect your wallet to ApeX Pro first. Under the ’Trade’ page, you will find the Testnet options displayed next to the ApeX Pro logo on the top left hand of the page.Select the preferred testnet environment to proceed.

Unable to Connect Wallet

1. There could be various reasons for the difficulty in connecting your wallet to ApeX Pro on both the desktop and the app.

2. Desktop

- If you use wallets like MetaMask with in-browser integration, ensure you’re signed into your wallet via the integration before logging in to Apex Pro.

3. App

- Update your wallet app to the latest version. Also, ensure your ApeX Pro app is updated. If not, update both apps and try connecting again.

- Connectivity issues might arise due to VPN or server errors.

- Certain wallet apps might require being opened first before launching the Apex Pro app.

4. Consider submitting a ticket through the ApeX Pro Discord helpdesk for further assistance.

How fast can I get a response from ApeX support?

As soon as possible, when ApeX receives your ticket concerning your problems on the Discord platform, they will respond to it within 7 days of your ticket being created.

In which language ApeX can answer?

Apex prefers English most of the time, but they have team members who can assist you using Mandarin, Russian, Bhasa, and Japanese as well.

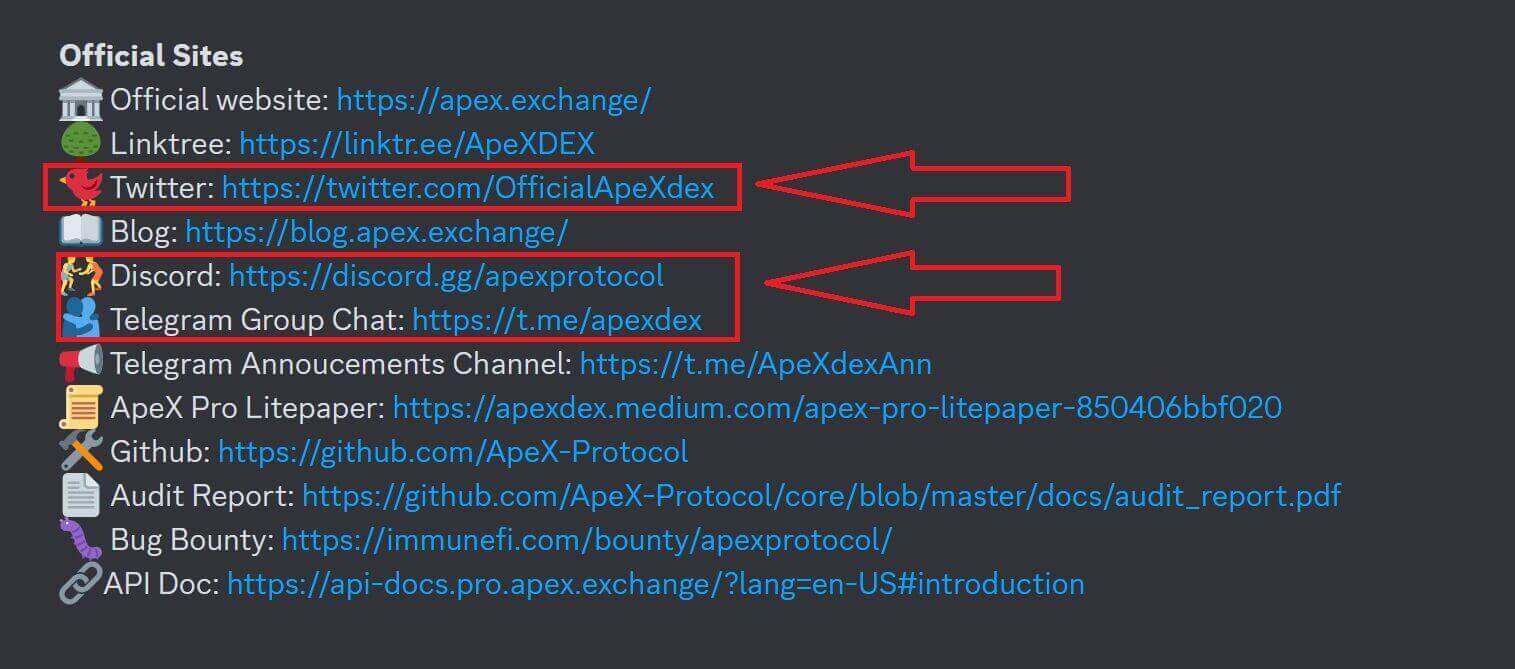

Apex Support by Social Networks

Apex can support you through Twitter (X), Discord, and Telegram. All of them are the main support Social Networks of ApeX, the link is below.

Withdrawal

Ethereum Withdrawals?

ApeX Pro offers two withdrawal options via the Ethereum network: Ethereum Fast Withdrawals and Ethereum Normal Withdrawals.

Ethereum Fast Withdrawals?

Fast withdrawals utilize a withdrawal liquidity provider to send funds immediately and do not require users to wait for a Layer 2 block to be mined. Users need not send a Layer 1 transaction to perform a fast withdrawal. Behind the scenes, the withdrawal liquidity provider will immediately send a transaction to Ethereum which, once mined, will send the user their funds. Users must pay a fee to the liquidity provider for fast withdrawals equal to or greater than the gas fee the provider would pay for the transaction and 0.1% of the amount of the withdrawal amount (minimum 5 USDC/USDT). Fast withdrawals are also subject to a maximum size of $50,000.

Ethereum Normal Withdrawals?

Normal withdrawals do not use a liquidity provider to speed up the withdrawal process, so users must wait for a Layer 2 block to be mined before they are processed. Layer 2 blocks are mined roughly once every 4 hours, though this could be more or less frequent (up to 8 hours) based on network conditions. Normal withdrawals occur in two steps: the user first requests for a normal withdrawal, and once the next Layer 2 block is mined, the user must send a Layer 1 Ethereum transaction to claim their funds.

Non-Ethereum Withdrawals?

On ApeX Pro, you have the option to withdraw your assets directly to a different chain. When a user initiates a withdrawal to an EVM-compatible chain, the assets undergo an initial transfer to ApeX Pro’s Layer 2 (L2) asset pool. Subsequently, ApeX Pro facilitates the transfer of the equivalent asset amount from its own asset pool to the user’s designated address on the corresponding withdrawal chain.

It’s important to be aware that the maximum withdrawal amount is determined not only by the total assets in a user’s account but also by the maximum available amount in the asset pool of the target chain. Ensure that your withdrawal amount adheres to both limitations for a seamless transaction experience.

Example:

Imagine Alice has 10,000 USDC in her ApeX Pro account. She wants to take out 10,000 USDC using the Polygon chain, but the Polygon’s asset pool on ApeX Pro only has 8,000 USDC. The system will let Alice know that the available funds on the Polygon chain are not enough. It will suggest she either withdraws 8,000 USDC or less from Polygon and takes out the rest through another chain, or she can withdraw the full 10,000 USDC from a different chain with enough funds.

Traders can easily and safely make deposits and withdrawals using their preferred chain on ApeX Pro.

ApeX Pro will also use a monitoring program to adjust the balance of funds across chains to ensure sufficient assets in varying asset pools at any time.

Trading

Will there be more trading pairs in the future?

1. As our scaling abilities grow, Apex Pro anticipates the introduction of numerous additional perpetual contract markets. Initially, during the Beta phase, we’re backing perpetual contracts for BTCUSDC and ETHUSDC, with numerous other contracts in the pipeline. Over 2022, our objective is to unveil over 20 fresh perpetual contract offerings, with a focus on listing DeFi tokens and the most actively traded cryptocurrency pairs by volume.What are the trading fees?

Trading Fees:

1. Fee Structure1. ApeX Pro employs a maker-taker fee structure to determine its trade fees, distinguishing between two order types: Maker and Taker orders. Maker orders contribute depth and liquidity to the order book by remaining unexecuted and unfilled immediately upon placement. In contrast, Taker orders are promptly executed, instantly reducing liquidity from the order book.

2. Currently, Maker fees stand at 0.02%, while Taker fees are set at 0.05%. Apex Pro has plans to roll out a tiered trading fee system soon, allowing traders to benefit from increased cost reductions on fees as their trading activity grows.

No, if your order is open and you cancel it, you will not be charged a fee. Fees are only charged on filled orders.

Funding Fees

Funding constitutes the fee paid to either long or short-term traders, ensuring that the trading price aligns closely with the price of the underlying asset in the spot market.

3. Funding Fees

Funding fees will be exchanged between long and short-position holders every 1 hour.

Please note that the funding rate will fluctuate in real-time every 1 hour. If the funding rate is positive upon settlement, long position holders will pay the funding fees to short position holders. Similarly, when the funding rate is negative, short-positive holders will pay long-position holders.

Only traders who hold positions at the time of settlement will pay or receive funding fees. Likewise, traders who do not hold any positions when at the time of funding payment settlement will neither pay nor receive any funding fees.

Your position value at the timestamp, when funding is settled, will be used to derive your funding fees.

Funding Fees = Position Value * Index Price * Funding Rate

The funding rate is calculated every hour. For example:

- The funding rate will be between 10AM UTC and 11AM UTC, and will be exchanged at 11AM UTC;

- The funding rate will be between 2PM UTC and 3PM UTC and will be exchanged at 3PM UTC

4. Funding Rate Calculations

The funding rate is calculated based on Interest Rate (I) and Premium Index (P). Both factors are updated every minute, and an N*-Hour Time-Weighted-Average-Price (TWAP) over the series of minute rates is performed. The Funding Rate is next calculated with the N*-Hour Interest Rate component and the N*-Hour premium/discount component. A +/−0.05% dampener is added.

- N = Funding Time interval. Since funding occurs once per hour, N = 1.

- Funding Rate (F) = P + clamp * (I - P, 0.05%, -0.05%)

This means that if (I - P) is within +/-0.05%, the funding rate is equivalent to the interest rate. The resulting funding rate is used to determine the position value, and correspondingly, the funding fees to be paid by long and short-position holders.

Take the BTC-USDC contract as an example, where BTC is the underlying asset and USDC is the settlement asset. According to the formula above, the interest rate would be equivalent to the difference in interest between both assets.

5. Interest Rate

-

Interest Rate (I) = (USDC Interest - Underlying Asset Interest) / Funding Rate Interval

- USDC Interest=The interest rate for borrowing the settlement currency, in this case, USDC

- Underlying Asset Interest =The interest rate for borrowing the base currency

- Funding Rate Interval = 24/Funding Time Interval

Using BTC-USDC as an example, if the USDC interest rate is 0.06%, the BTC interest rate is 0.03%, and the funding rate interval is 24:

- Interest Rate = (0.06-0.03) / 24 = 0.00125%.

6. Premium Index

Traders can enjoy discounts from the Oracle price with the utilization of a Premium Index — this is used to raise or lower the next funding rate so that it aligns with the level of the contract trade.

-

Premium Index (P) = ( Max ( 0, Impact Bid Price - Oracle Price) - Max ( 0, Oracle Price - Impact Ask Price)) / Index Price + Funding Rate of Current Interval

- Impact Bid Price = The average fill price to execute the Impact Margin Notional on the Bid side

- Impact Ask Price = The average fill price to execute the Impact Margin Notional on the Ask side

Impact Margin Notional is the notion available to trade based on a certain amount of margin and indicates how deep in the order book to measure either the Impact Bid or Ask Price.

7. Funding Fee Cap

| Contract | Maximum | Minimum |

| BTCUSDC | 0.046875% | -0.046875% |

| ETHUSDC、BCHUSDC、LTCUSDC、XRPUSDC、EOSUSDC、BNBUSDC | 0.09375% | -0.09375% |

| Others | 0.1875% | -0.1875% |

*Only BTC and ETH perpetual contracts are available now. Other contracts will be added to ApeX Pro soon.